It’s… the World Chess Championship in Singapore

by Doug Brodie

In this blog:

/1. It’s… the World Chess Championship in Singapore

/2. 5% fixed for 10 years – is the US Treasury about to start sweating?

/3. Why there is no Nvidia, Intel, IBM etc in the UK

/4. Understand your yield (not hers or his or theirs)

/5. The figures behind buy to let – costs, tax, gains, profits

/1. It’s… the World Chess Championship in Singapore.

An interesting insight from the sage folk at 7IM:

Chess is becoming seriously popular again. Partly fuelled by people taking it up during Covid-19, partly popularised by Netflix show The Queen’s Gambit, and partly due to smartphone technology and connectivity letting us play it anywhere, anytime. It’s also not limited by geography – an estimated 800 million people around the world played chess last year.

And of course, it’s big business. The new generation of grandmasters is hooking into the YouTube generation – five-time US champion Hikaru Nakamura has 2.5 million followers, which he’s turned into more than $50 million.

The World Chess Championship also tends to echo events in the wider world – the dominant global powers often produce the dominant chess players of the day. In the early 1800s, the chessboard battles were usually between England and France. Then German and Austrian competition heated up towards the start of the 20th century. And of course, the war between Russian and American chess players was anything but Cold.

The black and white battle this week is between the Chinese reigning champion Ding Liren and the 18-year-old Indian grandmaster Gukesh Dommaraju.

Honestly, the echoes feel too perfect. Both giant countries, both likely to define the coming century, one established and one starting to compete in the same space.

Three decades ago, the Chinese government began investing heavily in factories, technology manufacturing, and communications systems, aiming to increase productivity.

And India is now doing something very similar. Putting the money into infrastructure and real estate, and offering incentives to the manufacturing of technology, this country has become the fastest-growing major economy in the world… just at a time when Chinese growth is stalling.

Source: macrotrends.net

/2. 5% fixed for 10 years – is the US Treasury about to start sweating?

The US 10-year Treasury note is a reference asset – it tells the investing world what the debt markets think of US government borrowing needs. You can see from above that if the US government was a home on your street, the owner is deep in negative equity.

The Fed is expected to cut rates in the short term (keep an eye out for the reference 2-year note) however the clever economists at US firm T Rowe Price think that the 10-year could start dallying with a 5% yield in the next six months. Now remember, that is not new money – it is the yield created by the fixed coupon over the market price, so the firm is expecting the 10-year note to be sold off, thereby pushing down the capital value and hence increasing the yield.

They point out that the Treasury is flooding the market with new debt so producing an oversupply, and …. pushing down prices. They see a new President highly likely to emulate Viv Nicholson, and short term rate cuts - meaning to get higher income then investors will buy longer dated assets.

The trouble is, apart from the cost of debt, a higher yield is attractive to currency investors / depositors, so Trump may find the mighty dollar getting stronger, more expensive, when he needs it to be weaker. Perhaps like back in 2016, nothing will really change in the next Presidency.

/3. Why there is no Nvidia, Intel, IBM etc in the UK

Risk and reward. Concorde didn’t make money on plane sales, however, there is no doubting in any way the impact that it made on the UK as a leading engineering and aerospace nation.

Computing is a little like ice hockey – it moves exceptionally fast, and you can’t win by chasing the puck, you need to anticipate where it’s going to be and head to that spot.

Messrs Turing and Hawking would no doubt roll their eyes: in this ‘invest, invest, invest’ new era to grow the country back into economic wealth, the Treasury has cancelled the £800 million funding of a new supercomputer being built at Edinburgh University. It’s not an upfront cost, it’s funding over the next seven years.

Our current most powerful computer is the Isambard-AI in Bristol: it cost £225m to build, it was built by Hewlett Packard and contains 5,000 Nvidia superchips.

Six months is a long time in….. supercomputers. Old Isambard here is now no longer in the global top 50. And note that it was built by an American firm with American components.

What we have cancelled is an exascale supercomputer, better described by the FT than me:

Source: FT.

You can’t make an omelette without breaking an egg; we can’t grow a digital economy simply by being America’s customers.

As Bloomberg’s Merryn Somerset Webb phrases it: “Want to know why the UK can't grow?

This is why the UK can't grow:

The planning application for the Lower Thames Tunnel alone has run to 360,000 pages and cost 297 million pounds, which for context is twice what it costs the Norwegians to actually build the world's longest tunnel.

/4. Understand your yield (not hers or his or theirs)

There are two elements to income assets – one is the amount of annual income, the other is the price of the asset.

When you see a deposit account quoted at (say) 4%, you know that is a 4% yield on each penny of capital. However, if you deposit £100 today and assume the 4% is tax free (call it an ISA), then next year if the rate is still 4% YOU actually get 4.16%, and after 10 years, even though the interest rate is still 4% you would be getting 5.7%.

The difference is that YOUR yield is measured as the income you receive over the price you paid. If you let the income sit and compound, your yield to cost grows – the yield today is the yield for someone who buys the asset today – that doesn’t apply to you if you bought the asset ten years ago. This is how you end up with your own personal yield to cost of 10, 15, 20%, a time when you will very surely sit back and let the money do its job. This is precisely what Warren Buffett has done with Coca-Cola.

Buffett bought $1bn of Coca-Cola shares, this year he will receive $776 million dividends in cash. That’s a 77.6% yield to cost. Do you think he gives a hoot about the share price?

/5. The figures behind buy to let – costs, tax, gains, profits

Tom Redmayne is a chartered financial planner based in Cambridge who has put together a brilliant summary of the current position of a buy to let investor. He has a blog you can access here, however I humbly reprint for you his key charts on the matter.

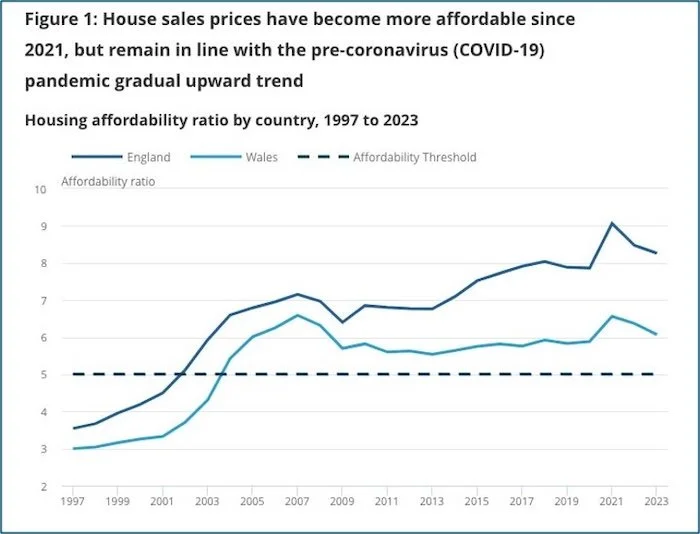

Source ONS, via Tom Redmayne

And the cost of borrowed money:

To buy in for a BTL there’s an additional 5% stamp duty on top, so for a £350k property that’s a total of £25,000.

And Tom has dug through ONS data from 2005 to 2023 to track both (average) UK house prices and annual rental yields.

When you’re retired you might want to run rental properties as an occupation to keep your hands and mind from being idle, though perhaps not...